Unimoni Gold Loan

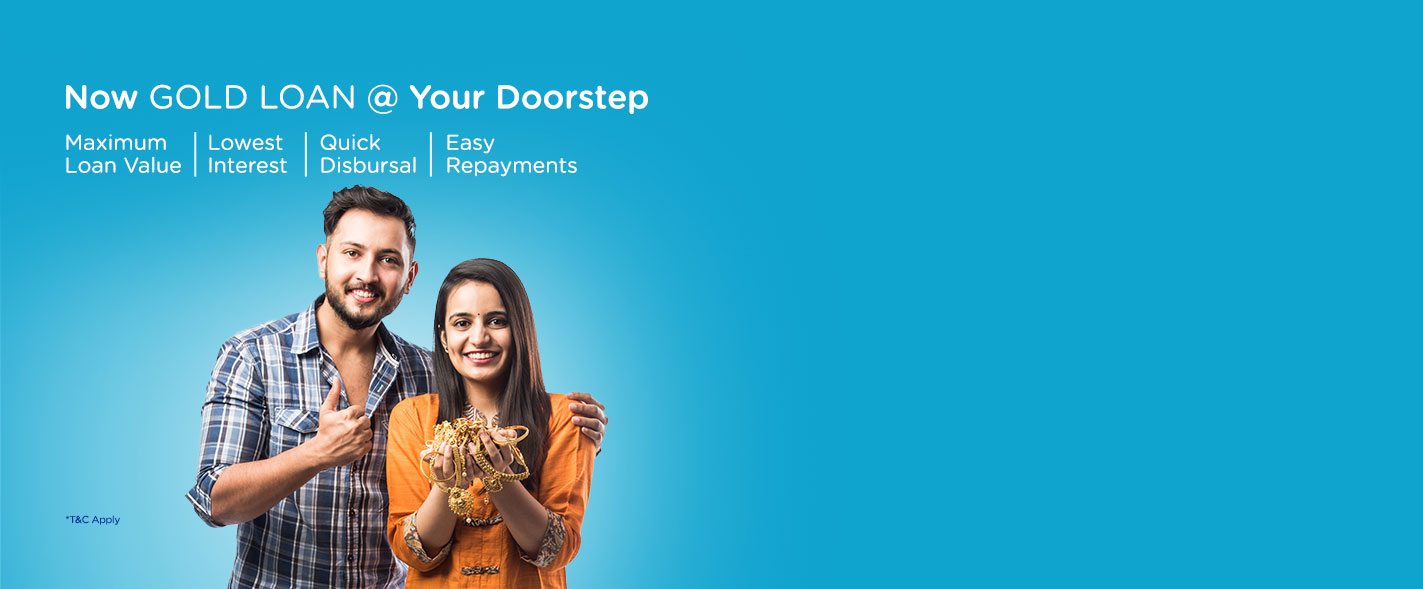

Gold loan for immediate cash. Pledge gold & get easy money with smart repayment options. Safe & secure with quick disbursement & higher loan to value.

Features

Maximum Loan Value - Unimoni gold loan offers you the maximum value for your gold. The "Rate per Gram" (RPG) is updated daily referring to the IBJA gold price of the day. Moreover, we consider the 100% weight of the gold ornaments to arrive at the loan value. All this will guarantee you get the best rate and need not search for a second source to meet your immediate fund requirements.

Quick Disbursal - Give your KYC and gold ornaments to our loan officer and get the disbursement completed within a few minutes. You need not wait for a gold smith to come to value your gold. Our in-house appraisers will do the valuation instantly. We are working on a digital platform that enables us to get instant approvals for your loans. You will receive the payment in your bank account immediately or you can collect cash from our counter itself.

Easy Repayments - It is made easy for making the payments in your loan. Be in your office or home, use our various digital options to transfer the fund to the loan account. You can make the payments using online banking, Mobile app, UPI, etc.

Experienced In-House Valuator - We have trained and experienced appraisers in our branches to evaluate the assets (gold ornaments). We assure you that ornaments will not be damaged due to an unprofessional appraising method.

Topup & Partial redemption Facilities - Avail more amount on your loan at any time, when your gold has more value. No need to do new valuation or KYC verifications. Check with our loan officer and get the fund transferred instantly. When you wish to take back an ornament, pay an amount only for that particular ornament and take back your favorite item without closing the loan in full.

No Hidden charges - We like to be fully transparent to our customers. Our Relationship executives will clearly explain the ROI and charges of each scheme to you before they complete the loan process.

Lowest Interest Rates - An affordable rate of interest is another attraction for you to choose our product. Low-interest rate keeps you away from a financial burden in the future. The rate starts from 1.5% (monthly) or 18% p.a and it will not get changed till the closing of your loan account.

Safe Custody of ornaments in vault with global industry standards - We value your assets, hence the best security supports are arranged to store your gold. All our branches have vault facility to store the gold. We have a professionally managed internal control system for managing the operations of these vault.

Anytime redemption - There is no minimum lock-in period for the loans. You can happily repay the loan amounts as per your convenience and get the pledged ornaments at any time.

Less documentation & Maximum tenure - Why should you carry a bundle of documents to avail a loan? Submit your PAN and address proof to our loan officer to start the loan process. Avail of a loan from Unimoni and stay relaxed since you get enough time to think about repayment. Our loan products are given the longest tenure for closing as well as interest remittance. Normally you need to remit interest on your loans once in 3 or 6 months and loan tenure will be up to one year. You can even renew your loan after one year.

Data Privacy & Protection - We value your privacy and guarantee that no personal information will be shared with third parties. All customer-related information is processed and stored in the digital platform which can be accessed only for the authorized personnel's of the company.

Login to our web or Mobile app to access the details of your loan account online and view the payment track, upcoming due dates, Overdraft eligibility and a lot more. You can even make payments to the loan accounts through it.Insurance for the Gold - We understand the value of your gold pledged with us. Your asset is covered under an Insurance policy for any type of probable loss that happens to it during the tenure of the loan. Moreover, we assure our customers that your emotional values on the gold also will be taken care of. Your ornaments are kept in our vault with utmost care and security

24 X 7 Customer Support - Our expert's team is always available to assist you all the time. Call us on 1800 102 0555 or Whatapp on 99460 86666

Email : customercare@unimoniindia.com

Gold Loan Schemes

Normal Interest Schemes

| Scheme Name | Base Interest | Interest Rest (Days) | Tenure (Months) | Processing Fee | Rebate % | LTV % | Loan Amount |

|---|---|---|---|---|---|---|---|

| WIZZMONI PRIME GOLD LOAN | 17.0% | 60 | 6 | Min 500.00 | 0.0 | 75.0% | Min 500000.00 |

| SWARNA SAMRIDHI PLUS | 24.0% | 90 | 12 | Min 200.00 | 0.0 | 75.0% | Min 10000.00 |

| WIZZ GOLD PULSE | 24.0% | 91 | 3 | Min 200.00 | 10.0 | 75.0% | Min 200000.00 |

| WIZZMONI SINGLESHOT | 26.0% | 91 | 3 | Min 200.00 | 10.0 | 75.0% | Min 200000.00 |

| WIZZ ONE | 24.0% | 91 | 3 | Min 200.00 | 12.0 | 60.0% | Min 10000.00 |

| UNIMONI MAX VALUE | 24.0% | 180 | 12 | Min 200.00 | 0.0 | 73.0% | Min 10000.00 |

| WIZZMONI FLEXIPAY | 24.0% | 182 | 6 | Min 200.00 | 6.0 | 75.0% | Min 10000.00 |

| SWARNA SURAKSHA | 24.0% | 365 | 12 | Min 200.00 | 3.0 | 75.0% | Min 10000.00 |

SCHEDULE OF CHARGES(INCL OF GST)

| PARTICULAR | PROCESSING FEE | NOTICE CHARGE | CREDIT SCORE CHECKING CHARGE | AUCTION INITIATION CHARGE | AUCTION CHARGE |

|---|---|---|---|---|---|

| Amount | Minimum 236 | 50 | 50 | 1180 | 5000 |

SLAB-WISE PENAL CHARGES

| SCHEME NAME | FROM AMOUNT | TILL AMOUNT | MAX PENAL CHARGE | INTERVAL DAYS |

|---|---|---|---|---|

| SWARNA SURAKSHA | 0.00 | 100000.00 | 150.00 | 30 |

| SWARNA SURAKSHA | 100001.00 | 150000.00 | 200.00 | 30 |

| SWARNA SURAKSHA | 150001.00 | 200000.00 | 250.00 | 30 |

| SWARNA SURAKSHA | 200001.00 | 250000.00 | 300.00 | 30 |

| SWARNA SURAKSHA | 250001.00 | 300000.00 | 400.00 | 30 |

| SWARNA SURAKSHA | 300001.00 | 2500000.00 | 500.00 | 30 |

| SWARNA SAMRIDHI PLUS | 0.00 | 100000.00 | 150.00 | 30 |

| SWARNA SAMRIDHI PLUS | 100001.00 | 150000.00 | 200.00 | 30 |

| SWARNA SAMRIDHI PLUS | 150001.00 | 200000.00 | 250.00 | 30 |

| SWARNA SAMRIDHI PLUS | 200001.00 | 250000.00 | 300.00 | 30 |

| SWARNA SAMRIDHI PLUS | 250001.00 | 300000.00 | 400.00 | 30 |

| SWARNA SAMRIDHI PLUS | 300001.00 | 2500000.00 | 500.00 | 30 |

| UNIMONI MAX VALUE | 0.00 | 20000.00 | 75.00 | 30 |

| UNIMONI MAX VALUE | 20001.00 | 50000.00 | 100.00 | 30 |

| UNIMONI MAX VALUE | 50001.00 | 100000.00 | 150.00 | 30 |

| UNIMONI MAX VALUE | 100001.00 | 150000.00 | 200.00 | 30 |

| UNIMONI MAX VALUE | 150001.00 | 200000.00 | 250.00 | 30 |

| UNIMONI MAX VALUE | 200001.00 | 250000.00 | 300.00 | 30 |

| UNIMONI MAX VALUE | 250001.00 | 300000.00 | 400.00 | 30 |

| UNIMONI MAX VALUE | 300001.00 | 2500000.00 | 500.00 | 30 |

| WIZZMONI FLEXIPAY | 0.00 | 100000.00 | 150.00 | 30 |

| WIZZMONI FLEXIPAY | 100001.00 | 150000.00 | 200.00 | 30 |

| WIZZMONI FLEXIPAY | 150001.00 | 200000.00 | 250.00 | 30 |

| WIZZMONI FLEXIPAY | 200001.00 | 250000.00 | 300.00 | 30 |

| WIZZMONI FLEXIPAY | 250001.00 | 300000.00 | 400.00 | 30 |

| WIZZMONI FLEXIPAY | 300001.00 | 2500000.00 | 500.00 | 30 |

| WIZZ GOLD PULSE | 0.00 | 100000.00 | 150.00 | 30 |

| WIZZ GOLD PULSE | 100001.00 | 150000.00 | 200.00 | 30 |

| WIZZ GOLD PULSE | 150001.00 | 200000.00 | 250.00 | 30 |

| WIZZ GOLD PULSE | 200001.00 | 250000.00 | 300.00 | 30 |

| WIZZ GOLD PULSE | 250001.00 | 300000.00 | 400.00 | 30 |

| WIZZ GOLD PULSE | 300001.00 | 2500000.00 | 500.00 | 30 |

| WIZZ ONE | 0.00 | 100000.00 | 150.00 | 30 |

| WIZZ ONE | 100001.00 | 150000.00 | 200.00 | 30 |

| WIZZ ONE | 150001.00 | 200000.00 | 250.00 | 30 |

| WIZZ ONE | 200001.00 | 250000.00 | 300.00 | 30 |

| WIZZ ONE | 250001.00 | 300000.00 | 400.00 | 30 |

| WIZZ ONE | 300001.00 | 2500000.00 | 500.00 | 30 |

| WIZZMONI PRIME GOLD LOAN | 0.00 | 2500000.00 | 500.00 | 30 |

| WIZZMONI SINGLESHOT | 0.00 | 100000.00 | 150.00 | 30 |

| WIZZMONI SINGLESHOT | 100001.00 | 150000.00 | 200.00 | 30 |

| WIZZMONI SINGLESHOT | 150001.00 | 200000.00 | 250.00 | 30 |

| WIZZMONI SINGLESHOT | 200001.00 | 250000.00 | 300.00 | 30 |

| WIZZMONI SINGLESHOT | 250001.00 | 300000.00 | 400.00 | 30 |

| WIZZMONI SINGLESHOT | 300001.00 | 2500000.00 | 500.00 | 30 |

-

Note:

Loan account will be classified as NPA, if the interest / principal is unpaid for more than 90 days from the due date.

Interest Rest Days - The Gold Scheme requires Interest Payment on every 30 day's interval. If not paid further DPD Penal charge will be applied from due date till customer pays the full interest.

Rebate Scheme - Rebate will be provided if Interest is paid on every due date if the customer pays the full interest. If not paid further DPD Penal charge will be applied from the due date till the customer pays the full interest.

-

Consumer Education on Overdue / NPA loans classification

Objective

With a view to increasing awareness among the borrowers on concepts of date of overdue, NPA classification and upgradation.

Interest Calculation Practices

● Daily balancing of loans - Interest amount shall be calculated on the daily outstanding balance in the loan account at the applicable rate.

● Month & Year – 30 days from loan sanction date will be considered as a month, and accordingly, 365 days consists of a year, which will be applicable to calculate the annualised interest rate.

● Interest Rest Days – Gold loan schemes requires interest payment on fixed intervals as per selected scheme.

Repayment Schedule Sample

Loan Amt:- 20,000 Loan Date:- 02/05/2024 Principal Due Date:- 01/05/2025 Interest Rest Days:- 90NPA ClassificationSl.No. Int Due Date Base Interest(%) Int.Amt Balance Amt NPA Date 1 30-07-2024 23 1135 21135 27-10-2024 2 28-10-2024 23 1135 22270 25-01-2025 3 26-01-2025 23 1135 23405 25-04-2025 4 26-04-2025 23 1135 24540 24-07-2025 5 01-05-2025 23 64 24604 29-07-2025 Total 4604

● Loans will be classified as NPA, if the interest/principal is unpaid for 90 days from due date.

Documents Required

Gold loans are provided to any Resident Indian who meets the KYC guidelines under the General Category against Gold ornaments pledged as collateral.